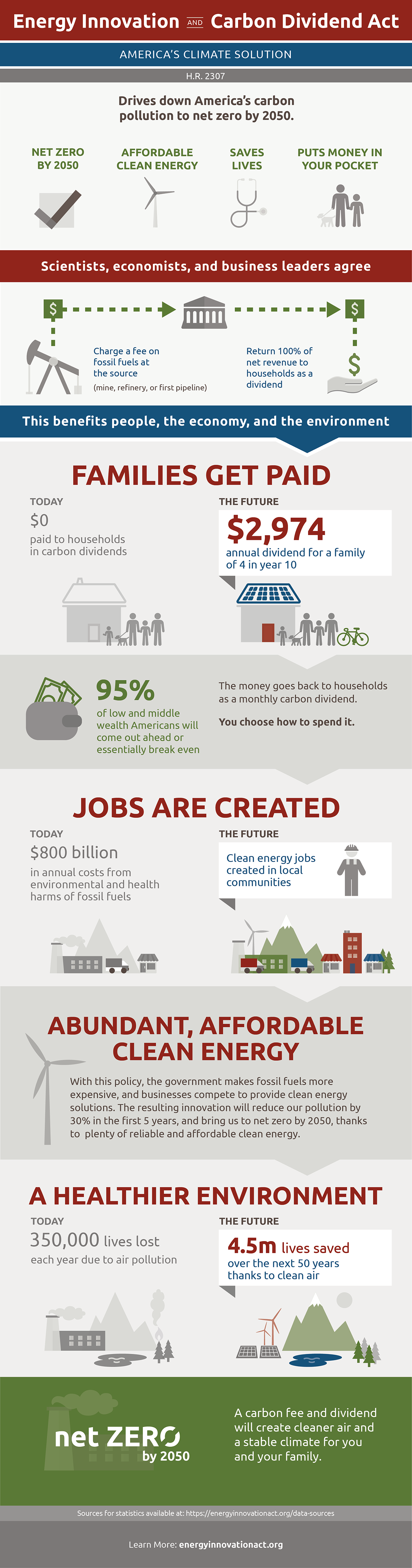

Is a carbon fee & dividend plan necessary?

Yes. While some people and industries are already cleaning up their carbon emissions, others will not move forward until there is a plan in place to incentivize them. When the program has reached its goal of cutting net U.S. greenhouse gas emissions to zero, it will automatically end.

Why is this plan necessary now?

The overwhelming majority of scientists have concluded that climate change is an urgent problem. A majority of Americans have come to agree, and are worried about the impact climate change will have on their livelihoods. Polls indicate Democrats, Independents, and Republicans are becoming more united in their support for action to curb carbon dioxide emissions that are the principal cause of climate change.

Where does the carbon fee start? Will it change?

It is a gradually rising fee on the carbon content of fossil fuels, to be assessed at the first point of sale. The fee starts at $15 per metric ton of CO2 equivalent emissions, and increases $10 per year. It encourages people and businesses to substitute cleaner energy sources, or find more efficient ways to use energy.

How much will my carbon dividend be?

In the first year, the carbon dividend will be about $16-24 per month, per adult. As the carbon fee rises annually, your monthly carbon dividend will also increase.

How does the carbon dividend work?

Equal shares are allocated to every adult with a SSN or ITIN (individual taxpayer identification number), with half shares allocated for each child under 19 years old. The dividend is administered by the Treasury Department, with costs over time not to exceed 2% of revenues. The first monthly payment will be made in the month prior to the program starting. The carbon dividend will be included in gross income for income tax purposes, but will not be included in means testing for Federal assistance. Nobody will lose Federal support as a result of carbon dividend.

How exactly do I get my carbon dividend?

If you file taxes, your carbon dividend will be distributed automatically each month. Similar to how your tax refund is mailed or direct deposited by the IRS every spring, your carbon dividend will come to you every month. If you do not file taxes, you will need to fill out a simple form indicating your number of dependent children and providing information on where to send your payments.

Is this the same as a carbon tax?

No. A tax has the primary purpose of raising revenue. By contrast, the government doesn’t keep the carbon fee revenue; instead, it is recycled to households as a carbon dividend. This doesn’t grow the government and is characterized as a fee rather than a tax.

Is this the same as cap and trade?

No. Cap and trade works by setting a “cap,” (maximum for total emissions) and then selling and trading permits for the right to pollute up to that cap. It requires bureaucracy to implement and run, and it creates price volatility that is difficult for businesses. A carbon fee is far simpler, with less bureaucracy, lower costs, and more predictability.

How much will this affect energy prices?

There are some forms of energy we buy directly, like gasoline and electricity. As a rule of thumb, each $10 per metric ton carbon fee would add about 11¢ to a gallon of gasoline, about 6¢ to a therm of natural gas, and 0.9¢ to a kilowatt-hour of coal-generated electricity. Energy costs are also embedded in most products and services we consume, so those would increase in price depending on carbon footprint, ranging from 0.2 percent for a TV to 1.1 percent for an airplane ticket (for each $10/metric ton increase).

How will farmers be affected?

American workers who grow our food and keep our economy strong are very important to the American economy. This policy provides an exemption for any diesel or gasoline used for agricultural purposes. Emissions from biological agricultural processes are not covered by this bill, as it applies only to fossil fuel emissions.

How will manufacturers be affected?

The Energy Innovation and Carbon Dividend Act includes a border carbon adjustment, which will apply to carbon-intensive trade-exposed imports from countries that do not price carbon similarly. This kills any incentive for U.S. companies to move production to a country that allows them to pollute more at lower cost. U.S. manufacturers will lose no ground economically for producing products with a lower carbon footprint.

How will other industries be affected?

Industries that use a lot of fossil fuels will adjust their operations to become less energy intensive or use clean energy instead. Industries that are less energy intensive will make fewer adjustments. The border carbon adjustment will protect industries at home and abroad from any goods that are produced more cheaply using fossil fuels. New companies and industries will emerge that innovate clean energy technology to make clean energy abundant and affordable.

How will the military be affected?

The Energy Innovation and Carbon Dividend Act provides a refund of carbon fee costs in covered fuels used by the military, including gasoline, diesel, or other fuels used for ships, planes, and ground transport, plus coal, oil, or natural gas used to generate electricity on military bases and in field operations.

The U.S. military has been actively pursuing alternative sources of energy for strategic and environmental reasons, and so will benefit from new developments in renewable and low-carbon energy technologies that will allow further emissions reductions.

Why must the U.S. shoulder the burden and cost for China, India and other polluters?

Under this policy, the U.S. will not shoulder any burden or costs on behalf of other countries. On the contrary, 12 of the world’s largest economies already have carbon pricing policies planned or in place. For example, in December 2017, China launched a nationwide carbon market targeted at their power sector, and they already regulate emissions from the electricity sector. India is rapidly deploying renewable energy and has imposed a tax on coal that has doubled in recent years. Both are imposing costs on pollution as a means to curb emissions, but like all nations, they still look to the U.S. for leadership and innovation.

Where can I read the full bill text of the Energy Innovation & Carbon Dividend Act?

See the full text and

download a copy of the Energy Innovation and Carbon Dividend Act.

Embed Infographic

Embed Infographic